The pandemic could trigger significant shifts in demand for office and residential space across the South East. With this in mind, we have assessed key locations in the region for their resilience to change and, ultimately, their potential to benefit from new spatial dynamics.

Download the full Thames Valley and South East Office Market Report 2021

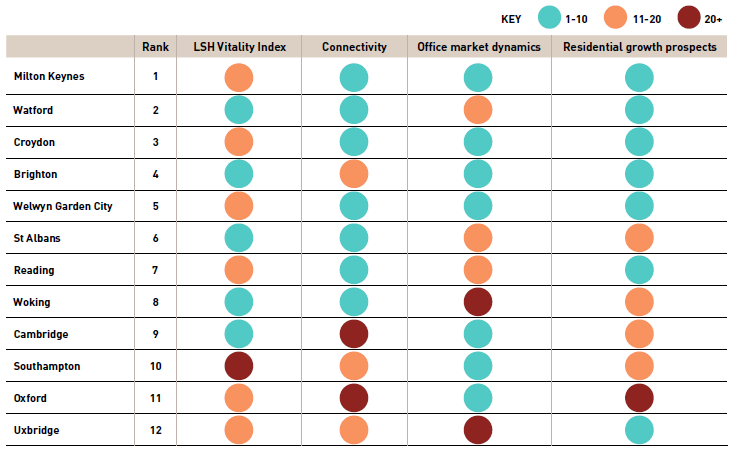

Using a mixture of economic and market-based statistics, four separate assessments have been produced to evaluate the prospects of 35 key locations. These assessments comprise; Office Market Dynamics, Residential Growth Prospects, Connectivity and LSH’s well-established Vitality Index.

Notably, while some locations feature highly across several rankings, no single town or city is ranked in the top ten of all four measures. This demonstrates that each location has its own particular strengths and weaknesses that will affect its prospects and direction of travel in the post-COVID era.

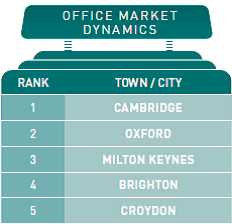

Office Market Dynamics

The Office Market Dynamics ranking assesses the current balance of supply and demand within each market, based on rental growth rates and availability. The size of the office stock is also considered, to gauge whether it provides the critical mass needed to support future growth in demand.

Cambridge and Oxford are the top two locations in this ranking, reflecting the current strength of demand from science and technology occupiers in both markets. The presence of world-class universities, clusters of knowledge-based industries and successful science and business parks puts both cities in a prime position to benefit from the acceleration in life sciences funding and investment that has been triggered by the pandemic.

Other highly-ranked locations include Croydon, which has seen strong occupier demand and rental growth in recent years. As Greater London’s largest suburban office market, Croydon is well placed to benefit if centrally-based occupiers adopt more decentralised office models.

Milton Keynes and Brighton are also ranked highly, with both being among the most dynamic South East office markets in recent years. Demand in both locations is boosted by growing clusters of high value technology occupiers.

Pictured: Cambridge

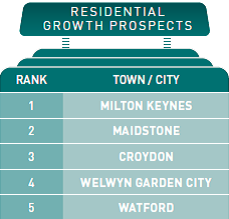

The Residential Growth Prospects ranking incorporates indicators of population size and growth, housing completion rates and the size of the current residential development pipeline. Large, growing towns are ranked highest, as they will have the greatest capacity to support workforces that may increasingly seek to work at home or live close to their workplaces.

With a fast-growing population and one of the largest residential pipelines in the South East, Milton Keynes is the top-ranked location on this measure. Sitting at the heart of ‘Oxford-Cambridge Arc’ growth corridor, the town is set to see continued rapid expansion. In its recently published ‘Strategy for 2050’, the local council said that it expects half a million people to live in Greater Milton Keynes by the middle of the century.

Maidstone comes in second place, with one of the region’s largest residential pipelines relative to its current population size. The top five is completed by Croydon, Welwyn Garden City and Watford, which are all expected to see strong population growth in the next decade.

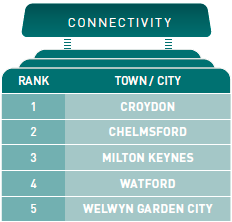

Connectivity

Connectivity is likely to be a key factor if the pandemic pushes firms to adopt flexible office models where employees’ working lives are split between their homes, central office hubs and local satellite or serviced offices. Towns and cities with busy train stations, short commuting times to London and relatively inexpensive office rents, may be the most viable locations for satellite and serviced offices.

Croydon is ranked top for connectivity, with a short 15-minute train journey to Central London. Prime rents are less than half the level of the City, making Croydon an attractive location for firms looking to spread their London office footprint.

With a commuting time to London of close to 20 minutes, Watford also scores highly for connectivity. The rest of the top five are Chelmsford, Milton Keynes and Welwyn Garden City, each of which is a relatively low-cost office location within a 40-minute train journey from the capital.

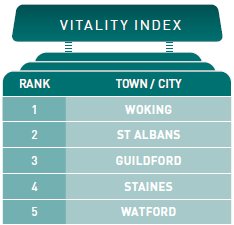

Vitality Index

The final component of the ranking is LSH’s proprietorial Vitality Index, our annual health check on UK locations which spans economic, business, lifestyle, health and environment indicators.

Woking came top of the 2021 index nationally, scoring particularly highly across health and environment indicators. The Surrey town was also one of the highest-ranked locations for a number of economic and business measures, including wage growth and commercial property investment.

Other South East locations ranked highly by this year’s Vitality Index include St Albans and Staines, which both scored highest across health and environment indicators; Guildford, whose strengths were primarily in lifestyle factors; and Watford, whose economic and business environment was highly rated.

Locating future growth

While each of the rankings is designed to assess a different aspect of the markets, if they are looked at in the round, Milton Keynes and Watford are the best-ranked locations, as the only towns to boast top five positions in three of the four rankings. Croydon, Brighton and Welwyn Garden City also stand out, with relatively high places in multiple rankings. However, all of these locations have at least one ranking in which they are relatively weak, bringing down their overall performance.

Several locations achieve a high overall ranking, despite not featuring in the top five of any of the individual rankings. Reading, at 7th overall, is the best of these ‘all rounders’, but Southampton and Uxbridge also display a well-balanced performance across the rankings.

Broadly speaking, the most highly ranked locations overall are either population centres in and around Greater London, which are well placed to benefit from any rippling out of office and residential demand from the city centre; and large town and cities located further out, with the necessary size and infrastructure to function as coherent economic entities in their own right. Both types of location have the potential to gain from shifts in spatial demand accelerated by the pandemic.

Source: LSH Research

Download the full Thames Valley and South East Office Market Report 2021

Get in touch

Email me direct

To:

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email